Your marketing performance doesn’t live in a silo and it’s not independent of external factors. One of those that will impact it is GDP (gross domestic product). But that brings many questions to marketers:

If our marketing is doing well during a period of GDP growth, is it because our marketing is effective or is it driven by the market? And vice versa, if our marketing isn’t being effective and we live in a period of recession, is it because of macroeconomic factors or is our marketing just not doing it? If it’s a combination of both, how do we know which percentage should we attribute to each?

Marketing teams tend to try to control for GDP hoping it will help allocate their budget more efficiently and know when their marketing performance is biased. The intent is the right one, but we believe the execution of controlling for it is not – there’s a better way. This is what we will cover in this article.

Understanding GDP and Its Impact on Marketing

To understand how GDP can impact your marketing performance, let’s do a quick refresh on what it is and what it encompasses: GDP represents the total value of goods and services produced within a country over a specific period – it is used as an indicator of economic growth and health. It has four main components: consumption, investment, government spending, and net exports.

The relationship between GDP and marketing activities is clear: as the economy grows, consumer purchasing power increases, leading to higher demand for products and services. The opposite is also true: during economic downturns, consumer power decreases and brands tend to see a lower demand from the market.

Let’s say you’re a D2C brand selling chocolate and you’re experiencing macroeconomic recession. The less consumption and purchasing power the market has, the less chocolate you will sell because families will cut their budgets. Now, does that mean your marketing isn’t working? Not necessarily. Your marketing performs better when GDP is growing, and worse when in downturns. Because of that, most marketing teams tend to try and control for GDP, but that’s not the best way to approach it.

Controlling for Economic Growth (what not to do)

Economic growth means your products are more in season, and an economic downturn means there will be less demand. If that sounds familiar, it’s because it resembles seasonality, and you should measure GDP just like you’d measure seasonality.

You don’t want to control for economic growth. The problem of trying to control for GDP growth is that your sales aren’t an independent variable to GDP. The idea is not to figure out how effective your marketing would be if GDP didn’t affect it – you want to know what you should spend given whichever macroeconomic conditions you’re faced with.

Back to the previous example of selling chocolate in a recession: your marketing report should not say that their advertising is great but they’re losing money because it’s a downturn. It should tell you what to do given what is happening – “we should cut our budgets by X% because we’re in a downturn and consumption is low.”

You want to model GDP, not control for it.

Ideally, you’re using Recast to model GDP. We use Bayesian MMM to model an ROI across each channel every single day instead of static ROIs. Just like the challenge most media mix models face with seasonality, you shouldn’t rely on models that give you the average marketing impact across all periods.

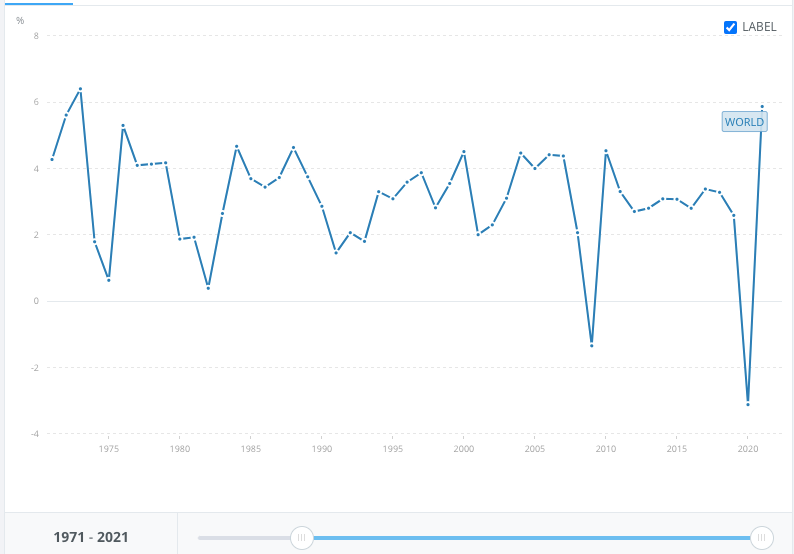

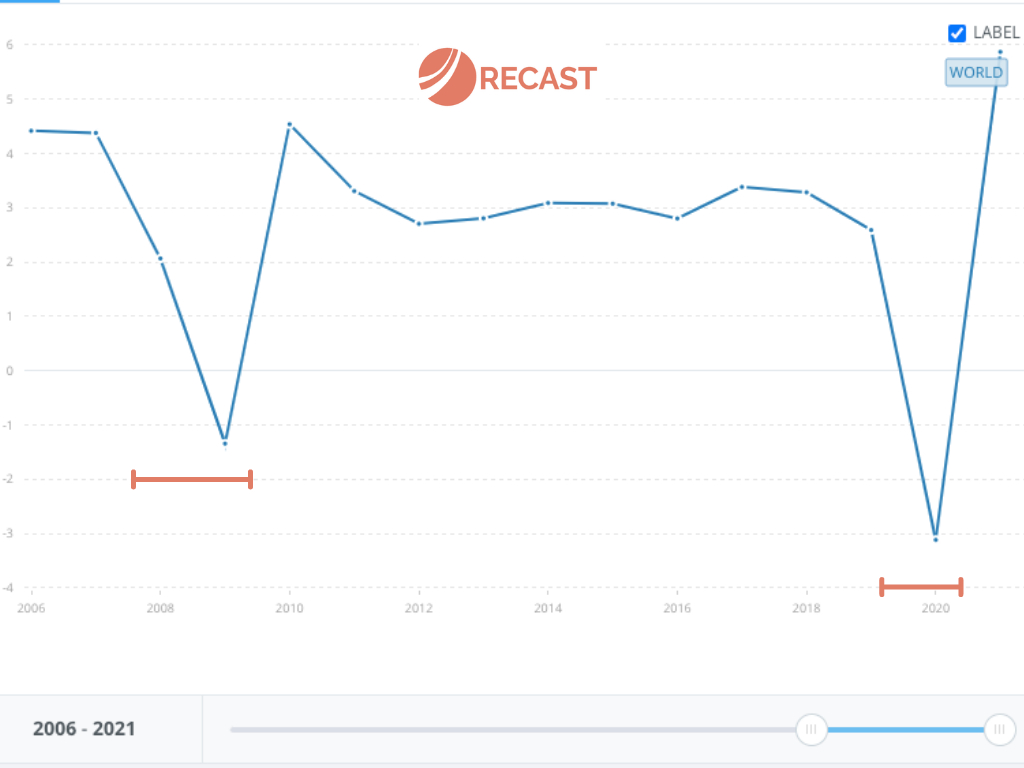

Your marketing won’t be as effective in the periods marked in the graph below vs the mean GDP growth.

That’s why it’s so important to use a good model that helps you align your marketing strategies with the current economic conditions, focusing on cost-effective channels and tactics during downturns, and scaling up investments when the economy rebounds.

With Bayesian MMM, we can also define prior observations and constantly update them with observed data – this creates a very flexible model that is dynamic enough to adjust when new data comes. We can also model for uncertainties, and incorporate hierarchies so you can see the impact of economic growth on various product categories, regions, or customer segments.

If you’re not using Recast, you should still understand how your model incorporates GDP. Again, just like with seasonality, it should not tell you that your marketing is doing great as long as you control for a recession – but that you’re in a recession and that your marketing isn’t doing so well because of it. That’s the difference between continuing to deploy budget inefficiently and making the right allocation decisions.

Conclusion

In summary, GDP plays a significant role in influencing marketing performance, and understanding its impact is crucial for marketers to make informed decisions. Instead of trying to control for it, focus on modeling GDP. Your budget allocation shouldn’t consider what would be happening if this variable wasn’t in play, but in what to do knowing it is.

This will help marketing teams align their strategy with current economic conditions and optimize their budget allocation so they can navigate periods of both economic growth and downturn.

As the economy continues to evolve, it is essential for marketers to stay vigilant and adapt their MMM capabilities accordingly – or use a model like Recast’s. By doing so, they can not only minimize waste in their marketing budget but also capitalize on growth opportunities.