In 2014 McKinsey published a study entitled “Grow Fast or Die Slow”, which examined thousands of software and services companies between 1980 and 2012. As the title suggests, they found that growth trumps everything else as a predictor of long-term success, even Return on Marketing Investment (ROMI). Companies with 60%+ annual growth, “Super Growers”, had 5x higher returns and 8x greater likelihood of reaching $1 billion in annual revenue.

When evaluating startups, growth mattered even more than profit margin or cost structure. Increases in growth contributed 2x more to valuation than equivalent improvements in profitability. These companies operated for years with a negative ROMI and were rewarded handsomely. Yet high growth companies are often lambasted in the media because of the shocking amount of money they’re ‘losing’. Slate’s Matthew Yglesias deserves credit for the best quote on this topic: “Amazon, as best I can tell, is a charitable organization being run by elements of the investment community for the benefit of consumers.”

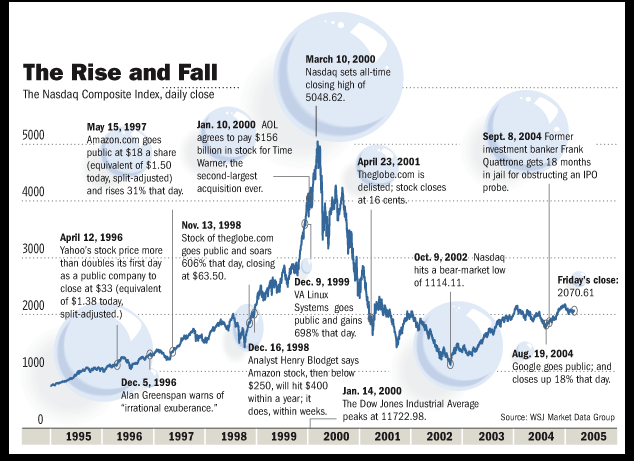

It’s not just Amazon: from Uber to Tesla, Netflix, DoorDash and WeWork, all fast-growing startups burning mountains of cash attract their fair share of schadenfreude. This became a persistent meme when the dotcom bubble burst in 2001, and companies like Webvan, Kozmo, and Pets.com imploded spectacularly after failing to reach profitability.

Yet this line of thinking is a false narrative. Amazon’s core books business was actually profitable very early on, with profits reinvested to build the unassailable moat that is their worldwide distribution network. Many projects fail, but the ones that succeed like Amazon Web Services, spin off billions of dollars in cash for the next round of experiments.

ROMI Definition

Return on Marketing Investment is how much net revenue was attributed to marketing divided by how much you spend on marketing. If your ROMI is less than 100% that’s considered wasteful, and if ROMI is more than 100% you made a healthy return. The ROMI formula is as follows:

ROMI = ((sales from marketing – cost of goods sold) / marketing expenditures) * 100So for example if your product costs $100 and it costs you $50 to product the product, and you spend $40 on advertising to acquire a new customer, your ROMI would be 125% = (($100 – $50) / $40) * 100. Typically companies aim for at least breakeven or a positive ROMI because spending more than you make is a dangerous game to play. However many of the world’s most valuable companies had long, sustained periods of negative ROMI in order to fuel rapid growth.

Unit Economics

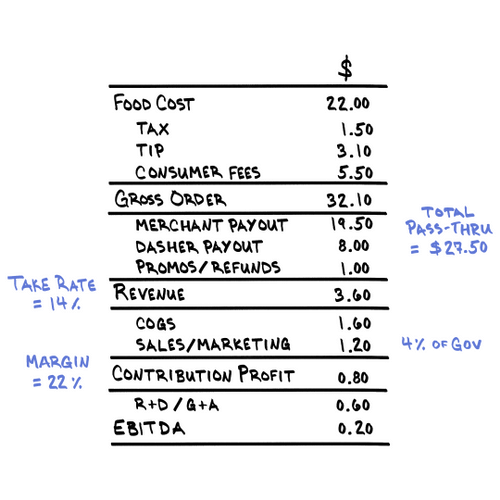

Of course, most of the cash-burning start-ups that get laughed about in the media aren’t actually even unprofitable, when you look at their costs on a per unit basis. DoorDash may have burned through half a billion dollars in 2021, but back of the napkin math shows that it very likely makes a 22% margin on the average food order.

According to these numbers, DoorDash sells $32 in food for every $1.20 invested in marketing, yet this is all sales divided by all marketing cost, the Marketing Efficiency Ratio (MER). To get ROMI we need to know how much revenue was attributed to marketing, so let’s assume a generous 50% (the remainder coming from organic new customers and repeat customers). This would give us a ROMI of 83% = (($3.60 – $1.60) / ($1.20 * 2)) * 100. Here we doubled marketing costs because only half of units sold came from marketing campaigns, so the cost is spread across a smaller base: it shows DoorDash is losing money on marketing-driven sales! How can it be possible to lose money when you make a profit on every order?

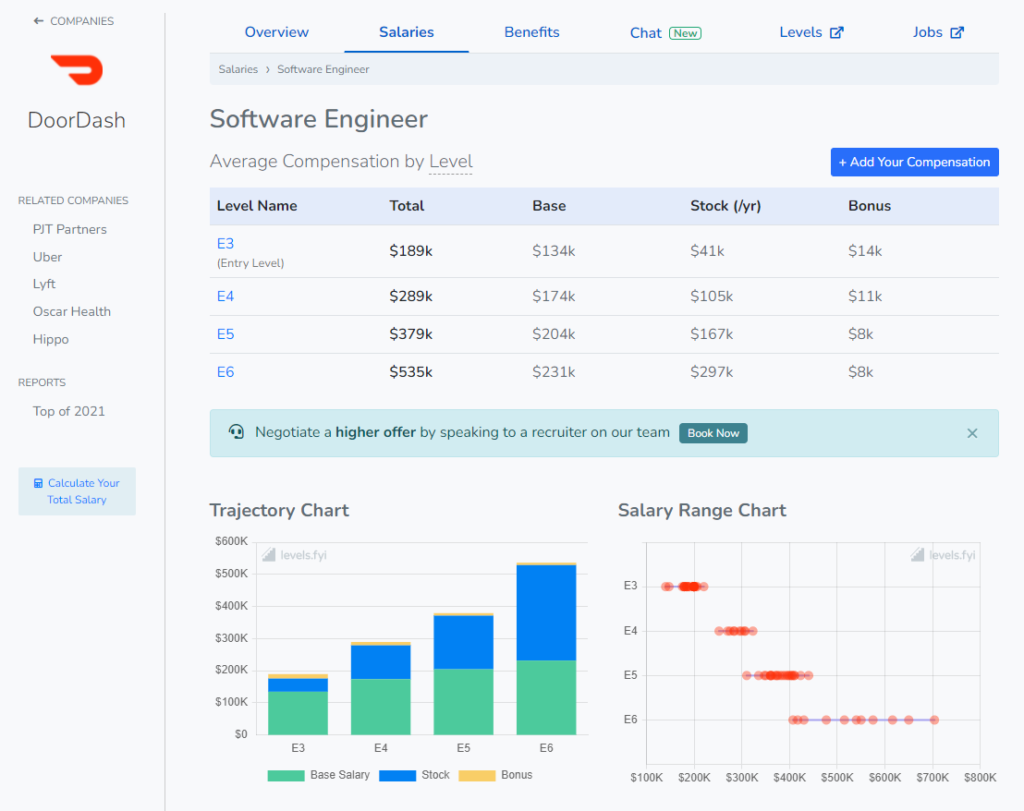

This is the difference between blended Return on Investment (ROI), which is positive, and ROMI which is negative. DoorDash hires armies of engineers, designers and product managers to improve the app and backend infrastructure, which makes up the a significant share of its costs – $0.60 on every $3.60 in revenue. DoorDash has 6,000 employees servicing half a million merchants, one million delivery drivers/riders and twenty million customers. They make $4.8 billion in revenue, or over $800,000 per employee. Software engineers at DoorDash’s headquarters in San Francisco earn $200k-$500k per year, in line with local market rates. They are responsible for building the app, which attracts a huge amount of organic users via word of mouth and retains existing users (we assumed 50%), and gives the marketing team something valuable to advertise.

If 100 or even 1,000 engineers disappeared tomorrow, the app would likely still continue to function as their systems are highly automated and scalable. Their customers would keep coming back because the app is on their phone, they get the emails, and they trust the DoorDash brand to deliver high quality service. They’d still continue to attract new organic users as existing users tell their friends. The only thing they’d lose with less employees is the ability to run as many new experiments to improve the service. The effects of which wouldn’t be felt for years. When Wall St analysts would congratulate Bezos on a good quarter, he’d say ‘Thank you’, but he’d be thinking “that quarter was baked three years ago”.

As the company matures, you would expect technology costs to shrink as a percentage of revenue, as it has for most successful silicon valley companies. They won’t need to spend as much on research and development as they did in the early days, because most of the hard challenges they needed to solve to get to scale are solved. There’s no guarantee they’ll get there, but there’s no guarantee that any investment will work out.

This is exactly why tech start-ups raise funding from venture capitalists: software is expensive to build, but when it’s built it can be highly scalable. So long as DoorDash doesn’t employ delivery drivers/riders directly or cook any of its own food, it can be viewed as a software company that just happens to work in food delivery. There should be no structural reason why it can’t achieve the 70-80% profit margins that are common for software companies.

Economies of Scale

There’s an old joke: “We lose money on every sale, but make it up in volume”. What commentators miss is that a business that loses money on every sale at small scale, really can make a lot of money after crossing a certain threshold. It’s because of Economies of Scale, or the tendency for things to get cheaper at higher volumes. If you’re buying a computer at the store, prices start at $1,300. Yet the manufacturer negotiated a price of $200-400 with Intel, depending on how many units they sell a year. The total initial investment to set up Intel in 1968 was $2.5 million (equivalent to $18.6 million in 2020) – and they certainly couldn’t profitably produce a $200 chip back then!

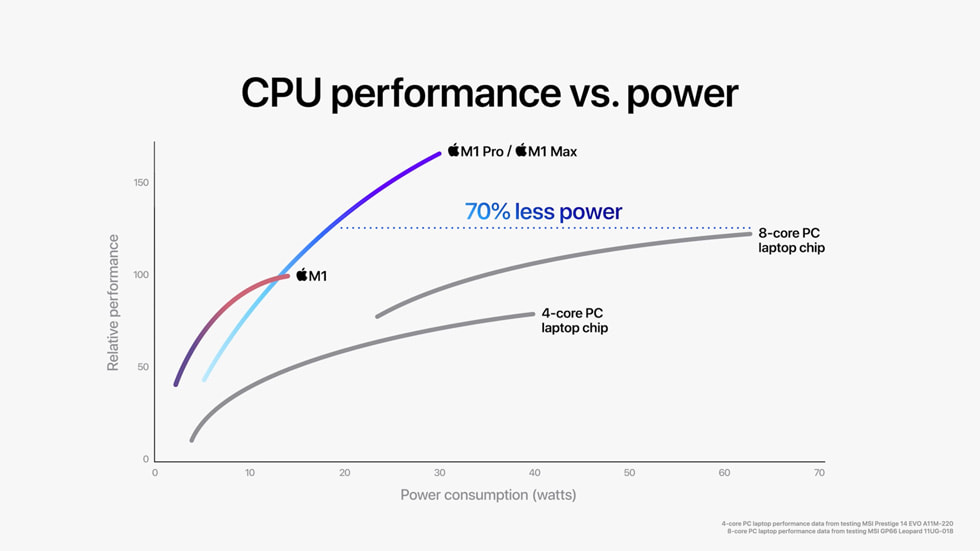

Now does it make sense to say Apple is ‘losing’ $10s of billions of dollars manufacturing its own M1 chips? It certainly could have banked that money, but it already spins off plenty of cash, about $100b a year. In fact, being too profitable is a sign to investors that you’ve lost the ability to innovate! Making their own chips means instead of paying $200 to Intel they can make them at $50, an estimated $2.5 billion saving per year. More importantly the M1 chips get better performance – which is a unique selling point – helping drive further growth: that’s what they really crave in the saturated market for computers and smartphones.

If you need to get to a certain scale to be profitable and negotiate good terms from suppliers, or justify building your own factory, then marketing is a great way to achieve that scale. Large-scale breweries destroyed their smaller rivals in the 20th century by mass-producing their product (at less than fifty cents a beer) and they got to that scale by paying for millions of dollars of TV ads. To this day the top 4 brewers claim 50% of a $500 billion market.

Lifetime Value and Market Expansion

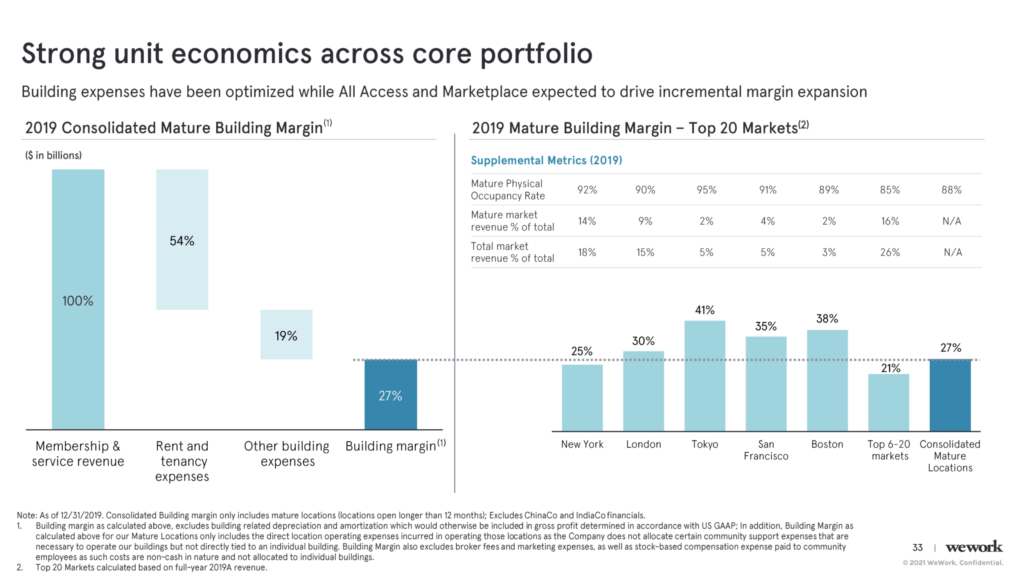

There’s a curious phenomenon that occurs in high growth companies: the faster they grow, the more money they lose. Not because they’re burning money haphazardly, but because the majority of costs occur up front, and in most business models the money comes later. For example when WeWork acquires a new office building, they have to pay a deposit up front just like you did when you moved into your apartment or home.

Say WeWork were seeing strong demand in New York with 1,000 tenants on the waitlist, it wouldn’t be unreasonable to secure a lease for a 200 unit office building. Because they’re renting whole floors for long periods, they can negotiate cheaper rent than they charge their customers. They’re all but guaranteed to fill that space and make a profit. However, the office buildout – sourcing and managing architects, designers, contractors, engineers, IT specialists, and other vendors to get the space ready for customers – can take 12 to 18 months and cost $150 to $250 per square foot.

If they had double that demand they’d be ‘losing’ hundreds of millions during these build out periods, but that would actually be a good sign! What would be more troubling is if the company stopped acquiring new buildings because they couldn’t fill existing demand: they’d be instantly profitable but in a lot of trouble. Of course it turned out they were too ambitious with their forecasts, but despite a global pandemic WeWork remains a multi-billion dollar public company with potential to reach profitability.

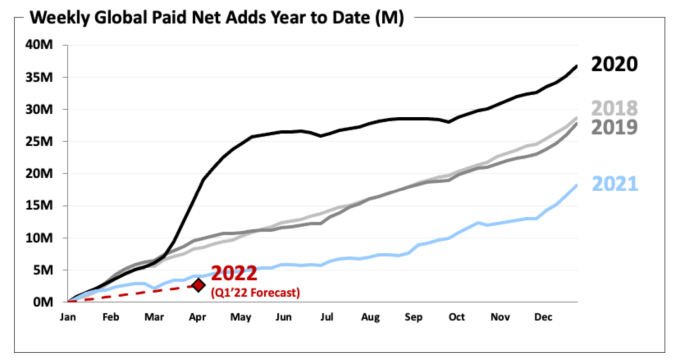

The same economic considerations apply to customer acquisition. Netflix pays approximately $44 to acquire a new customer, yet that customer only pays $9.99 per month for the service. That means the average customer will be unprofitable until their 5th month as a subscriber. If the customer leaves after month one they’ve lost $34! Yet the average customer actually stays for over 2 years, and is worth almost $300.

Now say that Netflix invests $10 million on a SuperBowl commercial and acquires 230,000 new customers. If they were operating at break-even before, they just burned 77% of that money. Of course over their lifetime these customers stand to make Netflix a 600% return on their investment. Compare that to parking that cash in an index fund of the S&P500, where you’d only have made a 50% return at the time of writing. What really moves Netflix stock is not when they burn boatloads of cash acquiring new customers, it’s when they’re unable to.

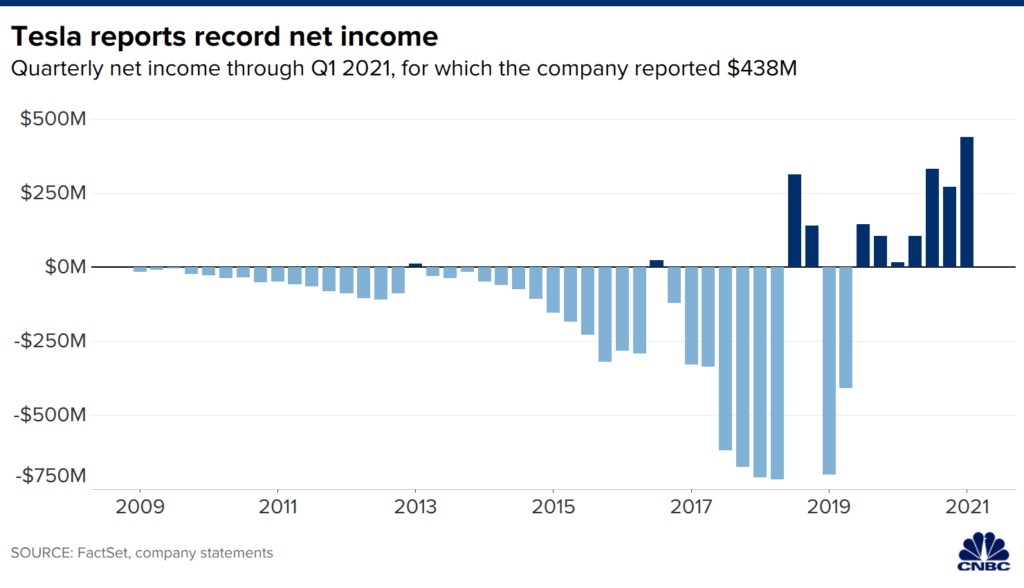

When Elon Musk sold PayPal to eBay, he famously invested all $180 million of the proceeds into Tesla, SolarCity and SpaceX, all of which were wildly unprofitable and at risk of bankruptcy for most of their history. The investments paid off, making Musk the world’s richest man with a net worth of $223 billion. Tesla earned its first annual profit in 2020, an amazing 18 years after its founding. Concerns about profitability evaporated as the company posted returns of $5.5 billion in 2021, up from $700 million the year before. Tesla’s profit margin on cars at 20% is higher than all its major competitors, with Toyota and Volkswagen at 17%, and General Motors, Ford and Fiat Chrysler at less than 10%.

What Should My ROMI Target Be?

Every company is different: just because Tesla managed to build a profitable electric car, and Netflix manages to keep their subscribers for 2 years, doesn’t guarantee your business will see the same results. As a general rule you should be conservative with investment in marketing during the early years before your product is proven, and then only scale up to keep pace with demand: never to generate demand that isn’t there.

Your personal goals for what you want your business to become may be different from Bezos’s or Zuckerberg’s. Not every business owner wants to be a public company CEO, or disrupt an industry. Good budget decisions start at the top with sound strategic decisions. Set your goal and work backwards from there to reverse engineer how much money you need to invest. The model of your business will always be changing and evolving as you scale, and there may be periods where you need to ‘flip the switch’ to turn on profitability. So long as you have profitable unit economics and invest in a reliable model for forecasting revenue, you’ll be in the best possible position to make these decisions.